Angola Namibe Basin 2019 Licensing Round

New insights for early development of a frontier area

Covering more than 65,000 km2, the Namibe Basin is one of the world’s largest remaining prospective frontier areas for oil and gas exploration. This southernmost basin along the West African salt margin has largely remained unexplored despite significant oil and gas activity in the neighboring Lower Congo and Kwanza Basins. To encourage exploration in the region, the Angola National Oil, Gas, and Biofuels Agency (ANPG) announced a 2019 public bid round covering approximately 54,000 km2 over blocks 11, 12, 13, 27, 28, 29, 41, 42, and 43 in the Namibe Basin and Block 10 in the Benguela Basin. The bid round represents an enormous opportunity to enter this frontier basin during its early stages of development.

Evaluate prospectivity by combining multiclient data with petroleum systems modeling

WesternGeco offers an extensive collection of more than 40,000 km of multiclient seismic, potential fields, and petroleum systems modeling (PSM) data to help you evaluate the prospectivity of the Namibe Basin. Gravity and magnetics data acquired simultaneously with our seismic data provide regional tectonic information to help resolve structural uncertainty in the basin and identify the oceanic-continental boundary and areas of major volcanic activity. PSM of the region confirms that the Barremian-Neocomian and lower Aptian lacustrine shales with Upper Cretaceous source rocks are likely to be mature in the south of the basin. PSM also suggests that the timing of maturation with respect to reservoir development is favorable in many places.

The bid round represents an enormous opportunity to enter this frontier basin during its early stages of development.

Explore your opportunities in a highly prospective frontier basin

The Namibe Basin represents an opportunity for early entry into a large prolific frontier basin. Our depth-migrated multiclient seismic and potential fields data combined with insights from our PSM will help you uncover the potential of this untapped resource, enabling you to accelerate hydrocarbon discovery.

Licensing rounds

The most relevant available data for bid rounds worldwide.

Gain access to the most relevant data available for bid rounds spanning the globe—from North America to the Middle East to Europe. Get the competitive advantage you need to select the best available prospects to meet the exploration goals of your operation.

Previous bid rounds

-

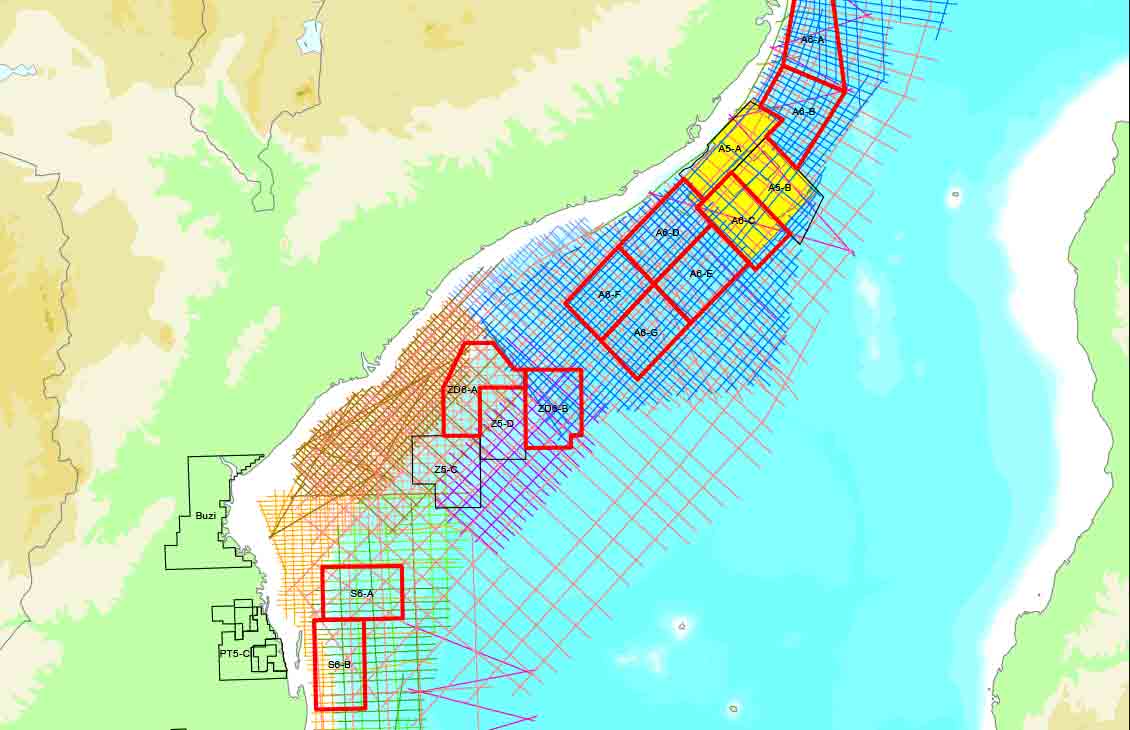

Offshore Mozambique

Multiclient data libraryLicense an extensive library of 2D and 3D seismic data covering the entirety of offshore Mozambique. View

-

Brazil Second Transfer of Rights Bidding Round

For prospectivity assessments in the Santos BasinIlluminate the Sépia and Atapu presalt fields with HD seismic data to accelerate exploration and appraisal. View

-

Brazil 17th and 7th Bidding Rounds

Post- and presalt imagingIlluminate the subsurface of the Campos, Pelotas, Potiguar, and Santos Basins with 2D and 3D seismic data. View

-

Egypt 2021 Digital Bid Round

Explore brownfield, greenfield, and frontier prospects in the Western Desert, Gulf of Suez, and Mediterranean. View

-

Malaysia 2020 Licensing Round

19,000 km2 of 3D broadband seismic dataEnhance your prospectivity assessments in Block SB 2T offshore Sabah, Malaysia. View

-

Angola Namibe Basin 2019 Licensing Round

54,000 km2 in the Namibe and Benguela BasinsEnter this frontier basin during its early stages of development. View

-

Egypt Red Sea 2019 Bid Round

11,000 km of long-offset 2D broadband dataDiscover an underexplored region with significant potential for hydrocarbon-bearing reservoirs. View

-

Onshore Mexico 3.2 and 3.3 Bid Rounds

>25,000 km of 2D seismic dataEnhance your onshore Mexico prospectivity assessments. View

-

Brazil 16th Bidding Round & 6th Presalt Auction

Five blocks in the prolific Santos and Campos BasinsImage post- and presalt targets to improve your prospectivity assessments and field development decisions. View