In this article

Dive into the four main factors making the energy transition faster, more resilient, and more bankable:

- Policy and regulatory momentum

- Market dynamics

- Technology derisking

- Innovative and collaborative financing.

Large-scale renewable energy deployment and key decarbonization solutions such as low-carbon fuel substitution, industrial electrification, energy efficiency improvements, carbon capture and sequestration, process decarbonization, and sustainable critical minerals production are inherently capital intensive. While global investment in the energy transition has reached record highs in recent years, most regions remain significantly underfunded relative to what’s needed to meet net-zero emissions targets by 2050.

Attracting capital and achieving sound project economics are fundamental to enabling the energy transition. Estimates suggest that it will require about USD 9 trillion in annual investment over the next decade to carry out a just and inclusive energy transition. Closing this gap demands coordinated action from governments, multilateral institutions—such as development banks and green funds—and private investors, alongside reforms that reduce both capital costs and the cost of capital.

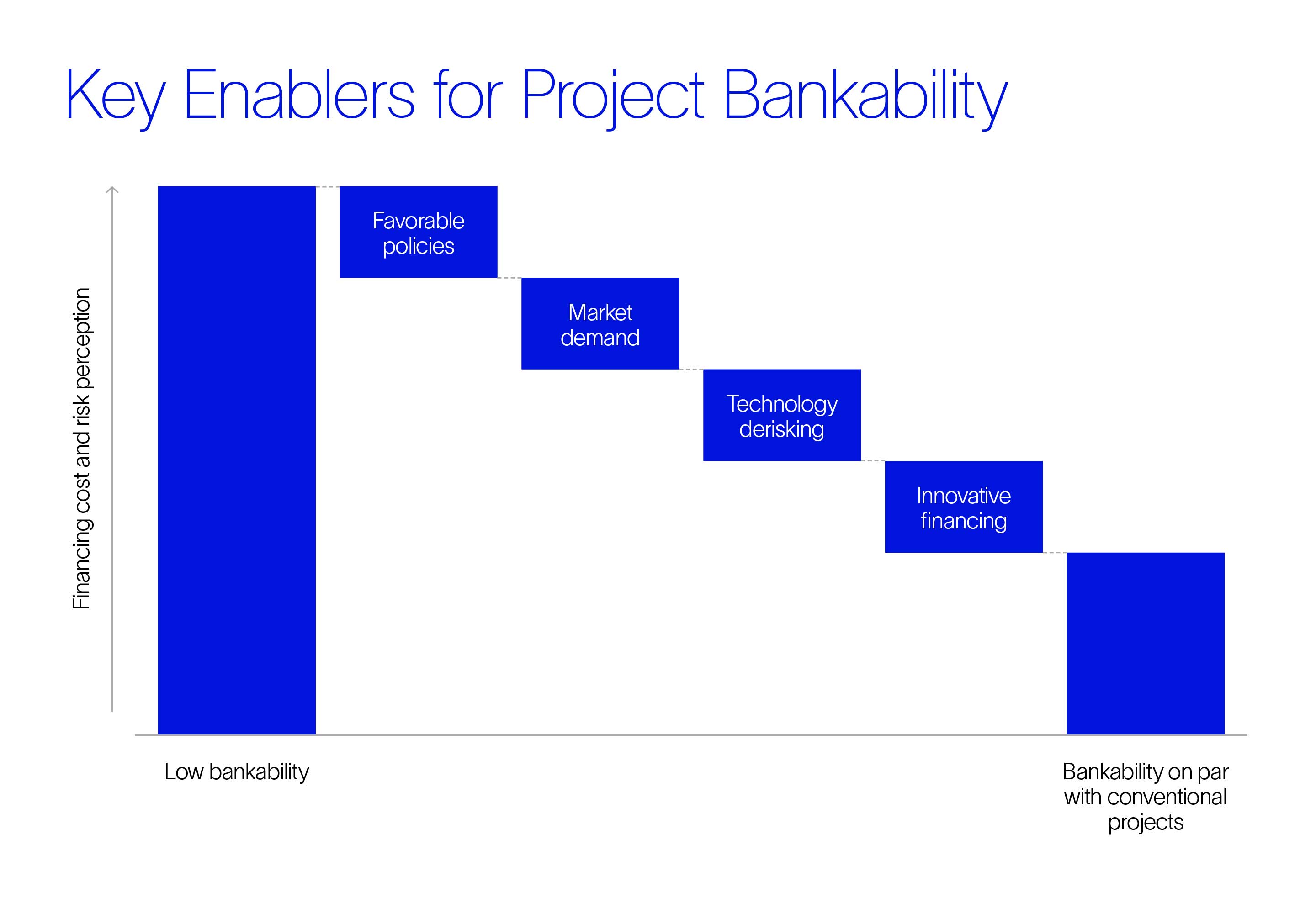

We’re ultimately talking about the confluence of four key enablers that will accelerate the deployment of clean energy infrastructure; support the development of a resilient, low-carbon global economy; and potentially enhance project bankability by significantly reducing project risks.

- Policy and regulatory momentum to enable first-of-a-kind (FOAK) projects and proof-of-concept deployments and incentivize novel, clean tech.

- Market dynamics to navigate uncertainties through robust economic fundamentals.

- Technology derisking to scale novel tech, with a focus on proof-of-concept use cases and technoeconomic validation.

- Innovative and collaborative financing to reimagine capital structure and improve capital allocation efficiency.

Policy and regulatory momentum for the energy transition

Policymakers play a critical role in establishing the foundational conditions, regulatory frameworks, and long-term momentum necessary for an economically viable transition to net zero. Historically, policies and regulations have been instrumental in driving the adoption of energy transition tech. A great example is the long-term growth and widespread deployment of solar energy as a key renewable energy source.

Government interventions such as tax incentives, grants, and loan guarantees are essential for bridging the financial gap between conventional energy sources and reliable clean energy solutions, thereby rendering the latter more bankable in the eyes of investors. A recent report from the US Congressional Budget Office, for instance, indicates that the total national investment in renewable generation from 2024 to 2026, particularly in solar and wind, would have been about one-third less without the support of the Investment Tax Credit and Production Tax Credit. Since their inception decades ago, these incentives have historically played a significant role in mobilizing private investment in clean energy.

In addition to financial incentives, regulators must reform obstructive practices that delay permitting and project approvals, hinder cross-state and international collaboration, and slow down public-private financing. Instead, their focus should shift toward fostering a transparent and cooperative regulatory environment.

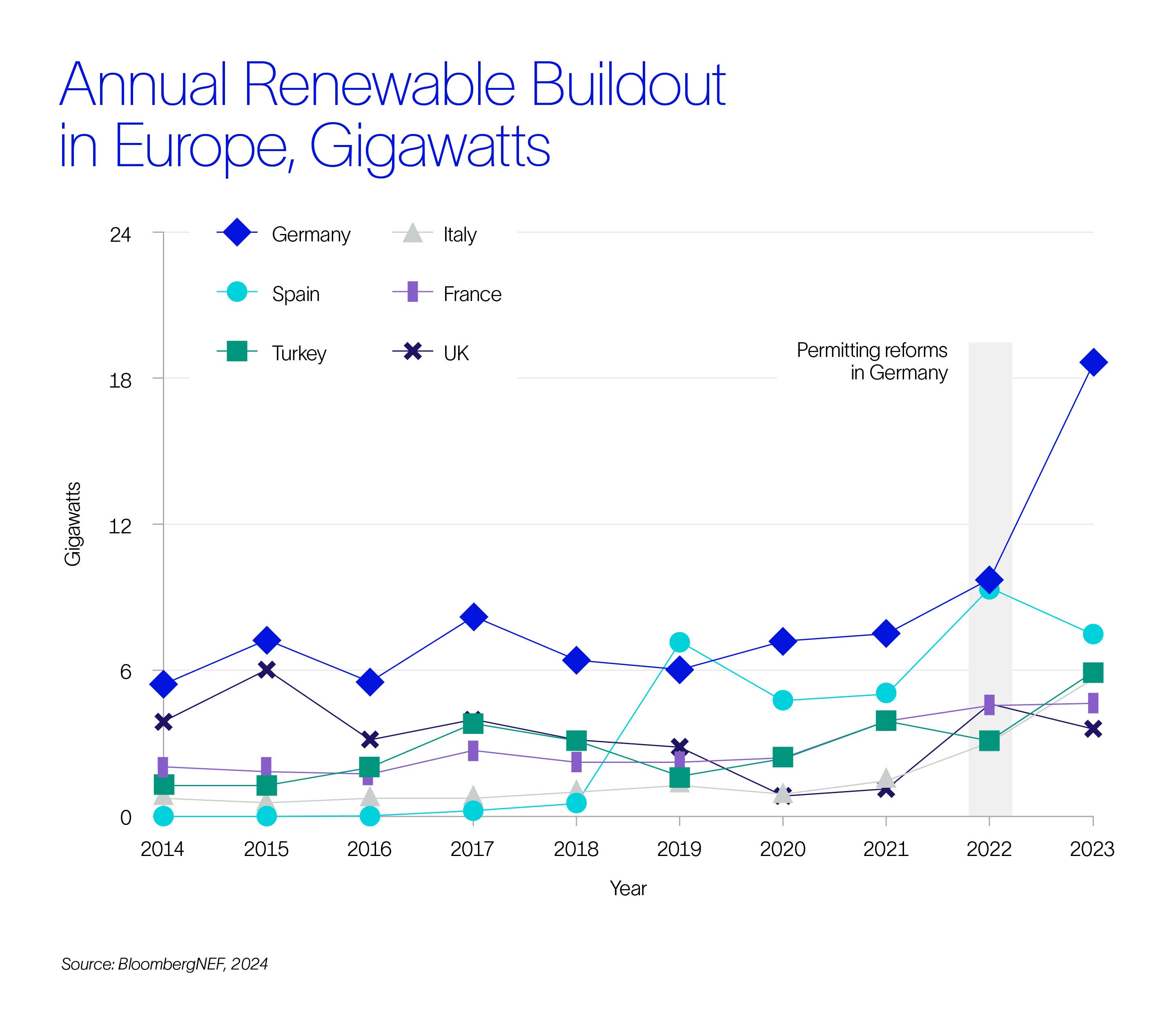

For example, Germany’s permitting reforms in 2022—a response to EU directives on renewable permitting—significantly shortened approval timelines, leading to an almost twofold increase in annual deployments from 2022 to 2023. To achieve these milestones, Germany adopted (among other methods) an “overriding public interest” designation for renewable energy development and introduced a digitized permitting process.

On the geopolitical front, a more balanced and less protectionist stance—one that broadens supply chains and helps maintain competitive project costs—has proven effective in attracting private investment. Geopolitical uncertainties, on the other hand, can introduce high volatility into project costs and render a project unviable in the eyes of investors, thereby hampering near- to mid-term investments.

Market dynamics needed for the energy transition

A key factor enabling the adoption of clean energy or low-carbon tech is strong market demand underpinned by a willingness to pay a green premium for reliable and uninterrupted sources of energy. However, when supply and demand are not aligned, the pace and certainty of capital deployment in energy transition projects are negatively affected. Offtake agreements that support future demand help drive innovation and capital allocation toward new forms of contracts.

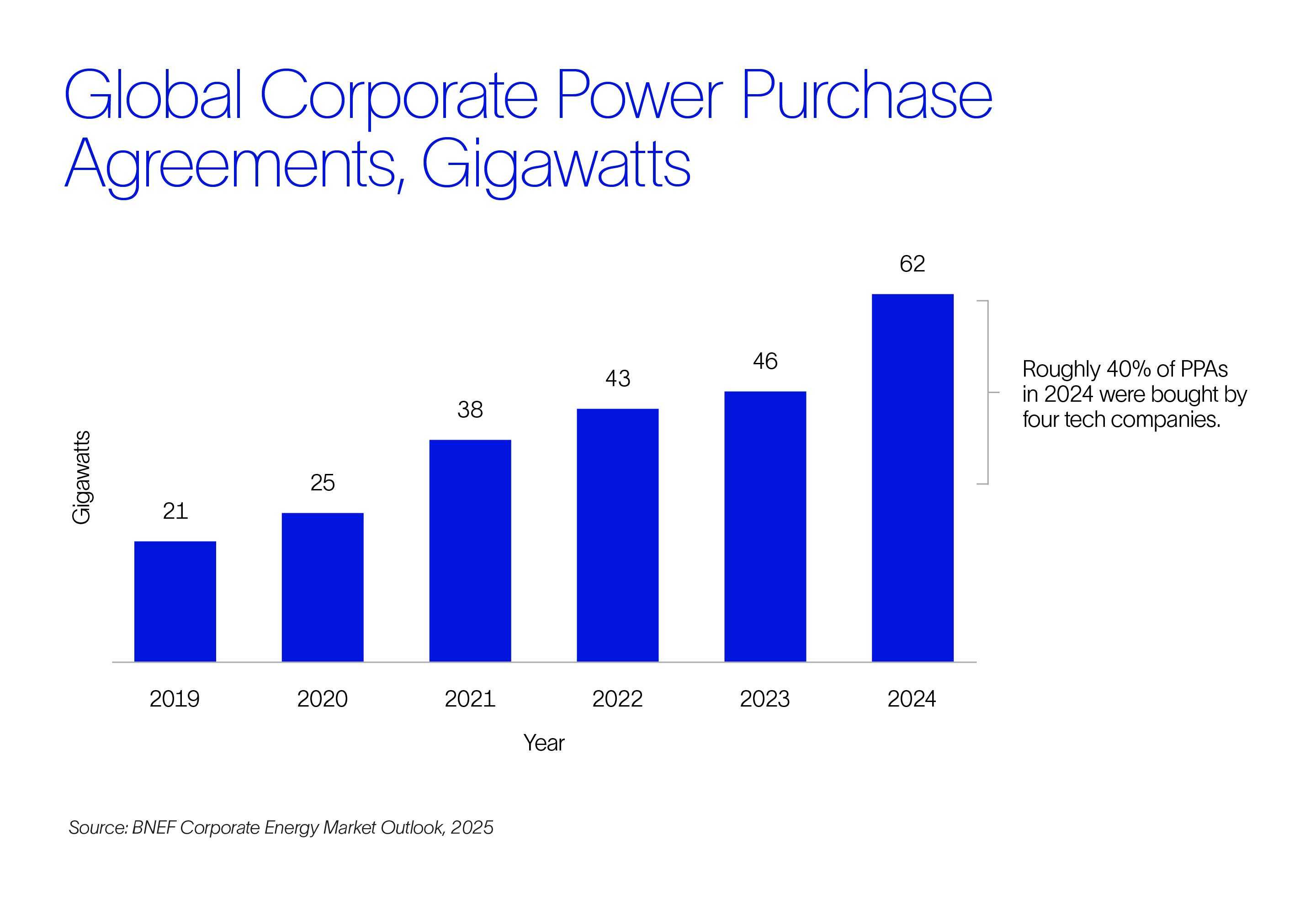

A misalignment in market dynamics can be observed in 2024’s slowdown of new final investment decisions (FIDs) for and increased cancellations of low-carbon hydrogen projects, largely due to ongoing cost challenges and uncertain demand signals. In contrast, 2024 witnessed a record number of clean energy power purchase agreements (PPAs) globally. According to BloombergNEF, this represented a 36% year-over-year increase, driven primarily by large tech companies, which accounted for approximately 40% of total contracted capacity. This surge reflects the growing energy needs of data centers, propelled by the rise of artificial intelligence (AI) and digitalization. These PPAs provide long-term price visibility and are crucial for improving the bankability of clean energy projects.

As a result, projects located in mature markets with strong demand signals and secured offtake agreements tend to be significantly more bankable than those in emerging markets, where future revenue streams remain uncertain. To accelerate investment in low-carbon infrastructure, targeted policies that boost both supply and demand are vital to building market confidence. Structured offtake mechanisms ranging from government-backed contracts for difference, feed-in tariffs, and feed-in premiums to private sector instruments such as PPAs, hedging swaps, and other forms of offtake agreements are essential tools for derisking projects, spurring demand, and securing more favorable financing terms.

Technology derisking required for the energy transition

The role of tech innovation remains central to making energy transition affordable. However, promising novel and FOAK technologies—even those with strong market fit—often struggle to achieve bankability due to their limited operational track record and high total cost. In the absence of stringent regulatory requirements or long-term policy commitments, private investors frequently perceive these technologies as riskier and more capital intensive compared to their established "grey" alternatives.

In such cases, government support is often the most viable pathway to scale. Public funding not only enables early-stage deployment but also plays a critical role in reducing both a technology’s perceived risk and costs through rapid learning and development. This support can come through grants, subsidies, and concessional clean energy loans for large-scale demonstrations and pilot deployments.

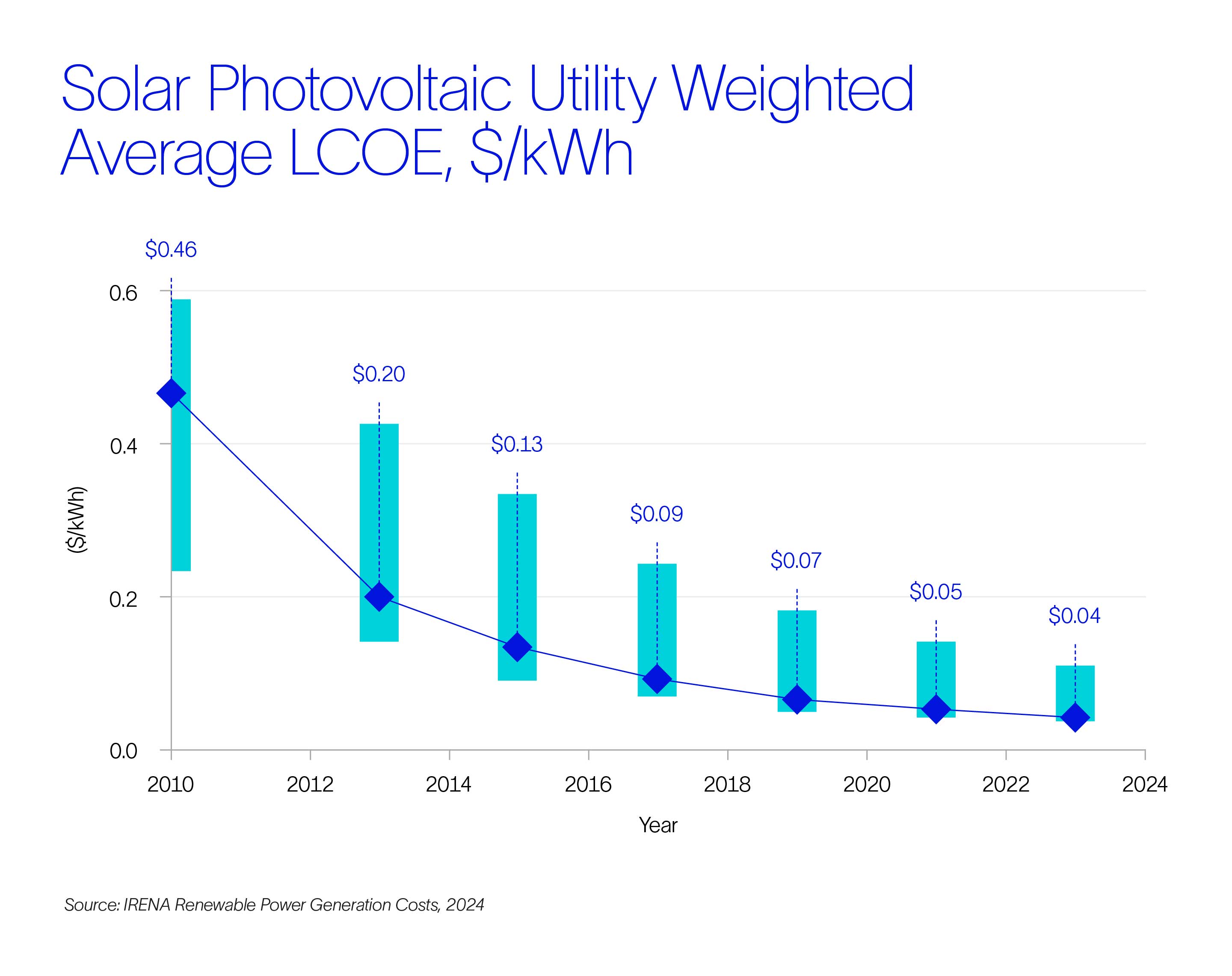

Solar power has made significant strides over the past decade in both adoption and affordability. For instance, the levelized cost of electricity (LCOE) for utility-scale solar has declined by 90% over the past decade, making its current cost comparable to (and in some cases, even more affordable than) power generation from conventional energy sources.

Beyond public funding, corporate equity investors play a pivotal role in accelerating commercialization. By contributing technical know-how, manufacturing capabilities, market access, business model execution, and operational expertise, corporates enhance the credibility and financial viability of emerging tech in the eyes of financiers.

Furthermore, regulatory frameworks that support the qualification of these technologies for sustainable debt instruments and carbon markets would significantly strengthen their investment case.

Innovative and collaborative financing for the energy transition

The scale and complexity of the energy transition demand a shift from conventional project financing models to more adaptive, risk-tolerant, and collaborative approaches. Financial innovation is not just about new instruments; it’s about rethinking how capital is structured, who bears risk, and how value is distributed across stakeholders. Here are some examples:

- Both voluntary and compliance carbon markets are emerging as powerful tools to monetize avoided emissions, improve project economics, and fund other green projects. In 2023, the EU emissions trading system not only reduced power and industry emissions by approximately 47% (compared to 2005 levels) but also funded the EU Innovation Fund. The fund—which has committed EUR 6.5 billion since then—successfully mobilized an additional EUR 35 billion from other sources. Such mechanisms effectively channel funds from high-polluting sectors to technologies and pathways that either hold high potential for reducing emissions or have already proven to do so.

- Innovative mechanisms such as results-based financing or pay-for-performance can even link financing to verified emission reductions. In addition, tokenizing energy assets, carbon credits, or project shares can democratize access to clean energy investing, thereby improving liquidity and reducing transaction costs. Regulatory certainty remains a challenge, but the integration of carbon credits into capital stacks, especially for nature-based solutions and carbon removal tech, is helping unlock new revenue streams. Meanwhile, blockchain-backed financing models (though still nascent) offer transparency and traceability and are particularly useful for environmental, social, and governance verification.

- Blended finance structures combining public, philanthropic, and private capital can help derisk investment, particularly in developing countries. For example, the capital stack in a blended model can involve:

- Government or philanthropic capital providing early-stage funding to absorb initial risk. This can include tax credits, concessional loans, or feed-in premiums that improve project economics over the long term.

- Consumers, such as corporate off-takers, coinvesting to secure long-term supply contracts—sometimes with the option to reduce their holding once the project is sufficiently derisked.

- Institutional investors entering with senior capital once key risks have been mitigated, thereby bringing scale and stability to the financing structure.

- Traditional green bonds can be supplemented with transition and sustainability-linked bonds, which allow companies in hard-to-abate sectors to raise capital tied to measurable decarbonization targets. These instruments expand access to climate finance for industries where strict use-of-proceeds criteria may not apply, while still aligning capital flows with net-zero objectives.