Profitability meets sustainability—the business case for digital decarbonization

已发表: 01/09/2026

Profitability meets sustainability—the business case for digital decarbonization

已发表: 01/09/2026

Growing demands for measurable progress toward net zero from regulators, investors, and communities are increasing the pressure on upstream oil and gas operators, to decarbonize while maintaining profitability. Digitally enabled solutions bring real-time measurement, analytics, and enhanced automation into operational workflows, empowering operators to plan and act with precision, so that sustainability strategies are not only designed but executed effectively. This digital transformation makes sustainability initiatives a driver of operational efficiency, risk mitigation, and lasting competitive advantage.

There are compelling reasons to invest in digital technologies, they allow companies to turn sustainability pressures into practical, data-driven improvements that can be continually measured, monitored, and reported. By directly linking sustainability objectives to value creation—whether through improved market positioning, reduced compliance exposure, or operational cost savings—digital solutions enable a mindset shift. Tasks that once required manual, resource intensive processes, like regulatory reporting or investor disclosure, can be streamlined and automated , ensuring accuracy and reducing compliance risk. Real-time data from these platforms links environment, social, and governance (ESG) performance directly to financial outcomes, supporting capital allocation decisions and enabling transparent reporting to stakeholders. More than a compliance checkbox; they enhance day-to-day operations by cutting downtime, improving efficiency, and streamlining workflows through data integration and advanced analytics.

Digital solutions offer real-time measurement of scope 1, 2, and 3 emissions, the ability to model decarbonization pathways, and tools to continuously monitor progress while automating reporting. By embedding these capabilities into the fabric of operations, companies can ensure compliance while simultaneously uncovering opportunities for cost reduction, risk mitigation, and performance optimization. With auditable, actionable data, performance becomes both visible and directly linked to business outcomes. This turns sustainability objectives into measurable value drivers.

Building the business case

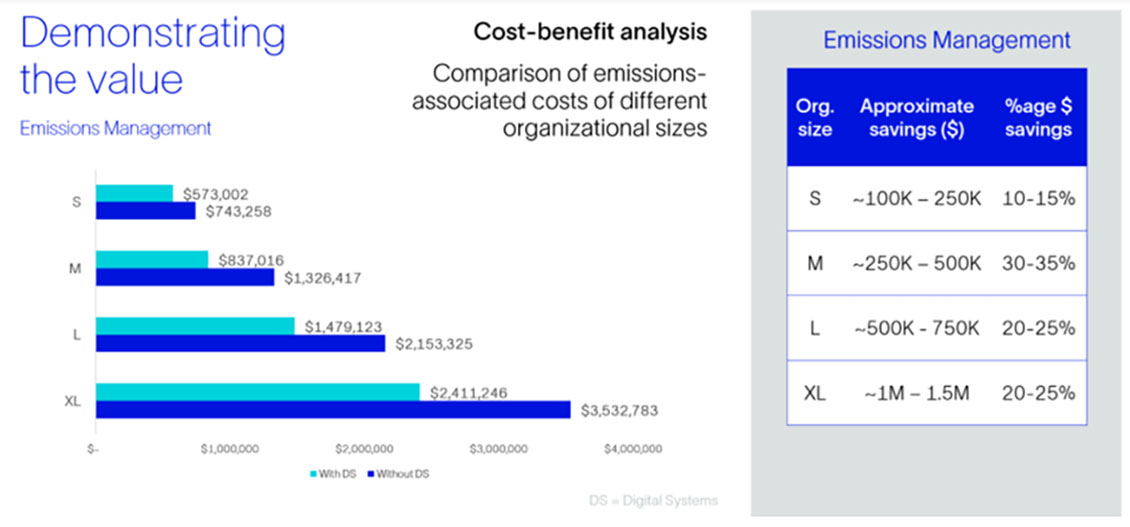

To make a compelling business case, it’s critical to map costs and benefits over a multi-year horizon, applying financial rigor (with metrics such as NPV, internal rate of return [IRR], and payback) just as with any major capital project. Our field experiences and discussions with multiple international energy players have highlighted key cost drivers:

- Technical and engineering expenses for emissions management

- Compliance and regulatory reporting

- Legal and audit requirements

- IT and data infrastructure

Recurring operational expenses include annual emissions measurement, climate scenario analysis, both internal and external audits, and upkeep of diverse, often fragmented data systems—creating inefficiency and redundancies. Digital platforms consolidate many of these processes, significantly reducing cost and complexity.

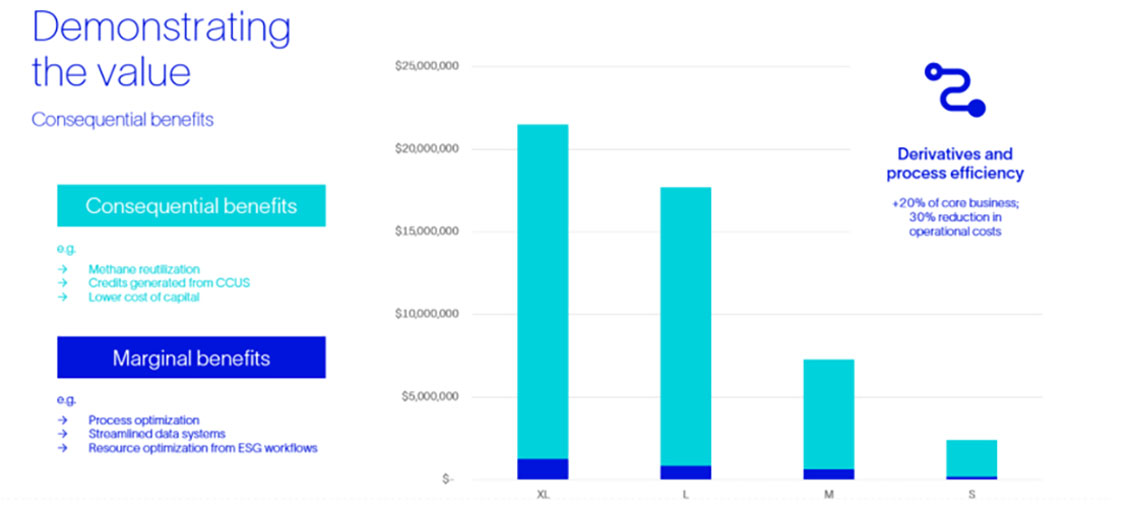

Benefits span both tangible and intangible areas:

- Operational savings: lower energy use, minimized downtime, resource efficiency.

- Risk mitigation: reduced regulatory penalties, litigation risks, and exposure to carbon price volatility.

- Revenue generation: monetizing carbon credits, reutilizing methane, improved ESG ratings for cheaper financing, and winning environmentally conscious contracts.

- Intangibles: a stronger reputation, stakeholder trust, and improved employee engagement.

Scaling and savings potential

SLB internal research reveals digital measurement, reporting, and verification (MRV) systems can generate benefits of USD 2 million to over USD 20 million, depending on operator size and numbers of emission measurement endpoints. Such granular measurement and tracking leads to improved planning and implementation of abatement technologies, translating measurement into measurable business value.

Strategic advantage in a low-carbon future

Deploying digital tools is about more than compliance, it’s about future-proofing businesses. They bring enhanced transparency, efficiency, and accountability, supporting stronger regulatory compliance, reduce transition risks, boosting reputation and investor confidence. They also pave the way for new revenue streams and help secure financing under favorable terms. Ultimately, digital solutions recast sustainability from a compliance-driven obligation into a strategic asset, driving long-term competitiveness and resilience.

For oil and gas operators, investing in digital solutions is no longer optional, it’s essential for operational resilience, financial performance, and competitive advantage in a low-carbon future.

Shy Murali

Head Climate Action Services – Digital Sustainability

Rajarshi Ray

Climate Subject Matter Expert

Related resources

-

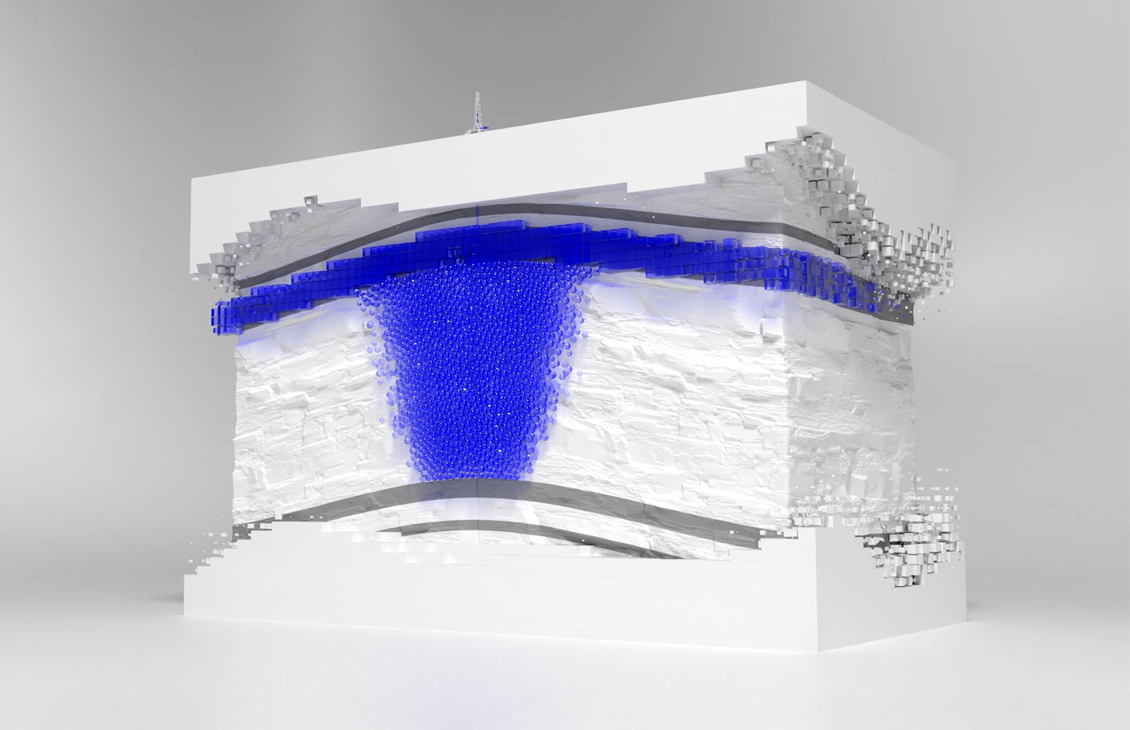

Intersect reservoir simulator

Industry-leading reservoir simulator for every assetIndustry-leading reservoir simulation technology—with the physics, performance and resolution you need for every asset.

-

Digital CCUS

Leverage digital to scale CCUS around the worldLeverage trusted technologies and proven experience to deliver end-to-end carbon capture and storage (CCS) projects.

-

碳封存

Sequestri碳封存解决方案让您的项目安心无忧Integrated solutions for selecting, planning, constructing, operating, and monitoring carbon storage sites.

-

SLB Collaborates with Northern Lights JV and Microsoft to Digitalize Carbon Capture and Storage Value Chain

-

Next generation CO2 storage modeling and simulation

Better simulation and field management solutions for your subsurface CCUS workflowsBetter simulation and field management solutions for your subsurface CCUS workflows

-

Digital delivers CCUS at speed and scale for climate action

Digital tech can turn CCUS into a powerful component of your company's climate action strategy.