The sourcing sales cycle across exploration and production (E&P) still operates in a time-consuming, relationship-driven manner. While justified by the current technical complexity of the products and services involved, the process also comes with pricing secrecy and long negotiations—two things that seem (and are) counterintuitive in today’s digital-first world.

This has left many stakeholders wondering if the process is still necessary as it is or if it’s ready for a revamp. The last few years have seen a shift in mindset as calls to improve efficiency throughout the value chain, including how we buy and sell, have grown increasingly louder. The question is: Can we overcome the considerable culture change of “how it has always been done?"

As is often the case, the key drivers of change are interlinked and have started a domino effect within today’s sourcing process. Here’s what we’re seeing.

Supply chain and availability...

Strain in the supply chain is a global phenomenon. In some cases, suppliers don’t have enough products in stock even for their largest and most loyal customers. This makes access to new suppliers, along with the ability to quickly evaluate and onboard them, a necessity for all buyers.

Access to available products, being prioritized, and unfavorable pricing have always been challenges for the little guys. However, this time-consuming exercise requires a greater number of resources from both the supplier and customer, especially when major service companies and operators are sourcing for multiple business lines at a higher frequency.

Made worse by excessive customization...

Technological differentiation and going the extra mile to satisfy the customer is often the difference between closing an opportunity or missing out. As a result, excessive customization of products and equipment, even when unnecessary, has become the standard rather than the exception in our industry.

There’s just one catch. A laundry list of specification options for each product, piece of equipment, and service increases both lead times and inventory risk for the manufacturer, not to mention what it adds to the final cost for the customer.

Excessive customization also drags out the technical sales cycle. One supplier told me that it often takes up to a dozen touch points between their sales team and a customer’s procurement team to finalize product specifications and agree on pricing. Given our discussions with various suppliers over the years, that’s more than common—it's the norm.

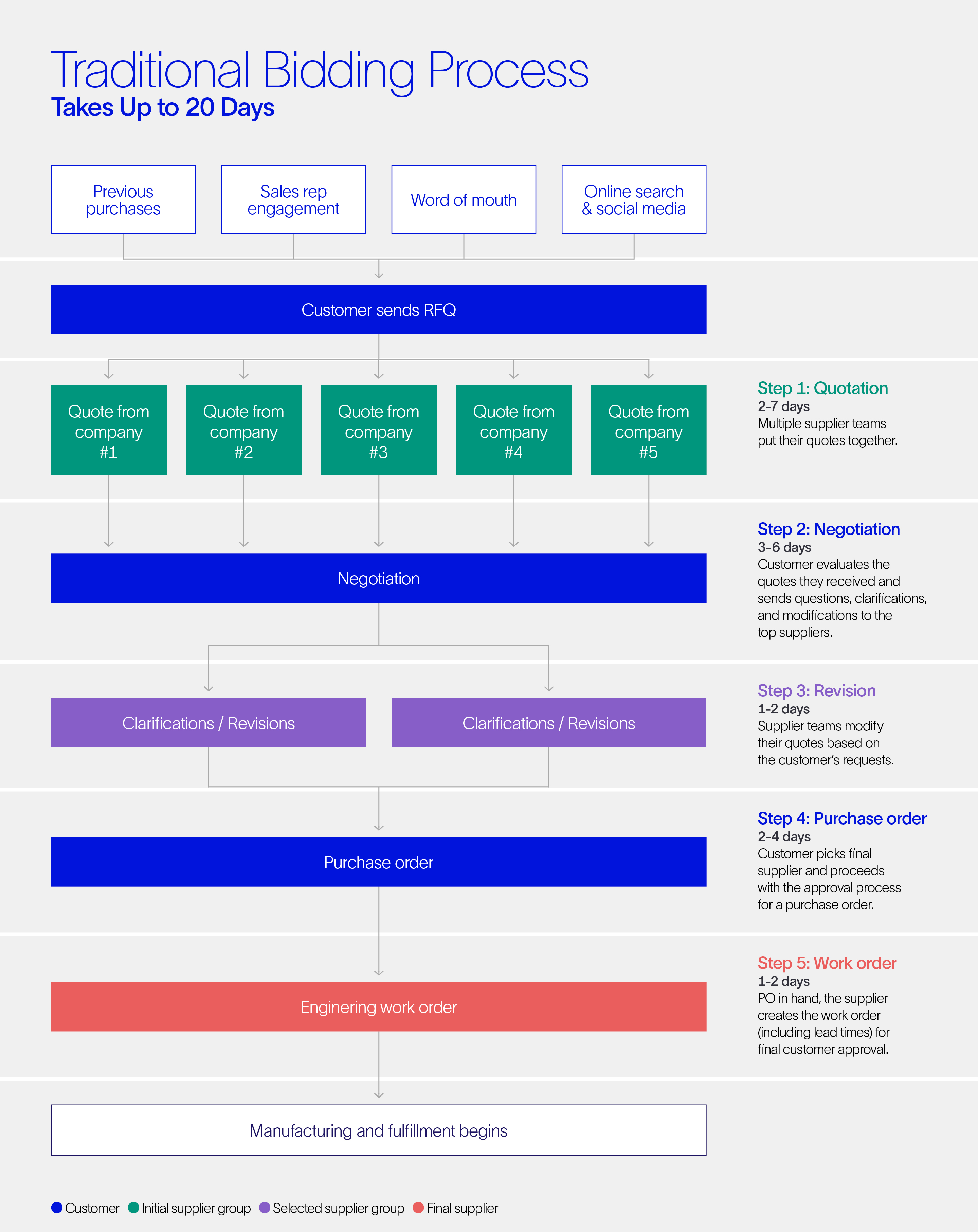

To reduce their own risk in this process, customers blast a widespread “request for quote” (RFQ) across multiple suppliers to ensure the likelihood of a successful fit and optimal pricing through competitive negotiation. This levies a significant resource toll on suppliers as they scramble to manage large numbers of bid requests that (let’s be honest) often have an uncomfortably low win rate.

Which exacerbates people and structure challenges...

Relationship-based sales coupled with cumbersome RFQ methods and highly customized products require significant resources and administration to execute. The workforce needed to perform these tasks alone has turned into a showstopper for many, and recent events have only made matters worse.

Let’s review what happened over the last few years. Activity reductions due to COVID shutdowns severely impacted a supplier’s ability to fan large teams of sales representatives across the country. The structure cost could no longer be justified in a still-competitive market where margins were already slim.

Then, as the economy reopened, demand surged, and oil prices rose, suppliers experienced newfound hope that things would bounce back completely. They quickly realized, however, that the same inability to attract and hire personnel that is plaguing all industries had peaked within the oil and gas industry.

The silver lining is that these two successive factors—personnel and structure costs and availability—are likely to drive lasting change as both suppliers and customers look for alternative means of operating.

And fails to leverage digital for customer engagement.

Apart from maintaining the status quo, there is hope in capitalizing on new and innovative solutions throughout the sourcing sales cycle.

The failure of the oil and gas industry to effectively pivot until now has impeded its ability to leverage digital in addressing customer engagement challenges and repetitive administration. Does this mean that sales and procurement resources or customized products and equipment are no longer needed? Of course not.

Premium relationships and engagements (including highly engineered solutions) are always going to play a role in the energy work environment. That doesn’t, however, mean that we shouldn’t be asking ourselves whether we’re keeping a key tool out of our people’s belts. A key tool that would not only allow for better usage of their time in reaching new customers and suppliers, but also help them provide a better fulfilment experience for repeat customers.

This could very well be the best of both worlds and we’re simply too set in our ways to see it. Just think: If you were to start your own venture in the energy industry today, what would that modern procurement and fulfilment process look like? What expectations do you (and everybody else) have?

Exactly.