With a growing population of over 4.3 billion people, a strong economic growth outlook, and low energy consumption per capita, Asia will remain central to the world's energy demand over the following decades. That said, the region also accounts for half of global greenhouse gas (GHG) emissions, presenting it with an amplified version of today’s dual challenge: meeting growing demand with reliable, accessible, and affordable energy while simultaneously decarbonizing for a sustainable future—and doing it quickly.

While progress is being made in departing from coal and accelerating the integration of renewable sources, Asia’s expansion in energy demand continues to outpace that of its low-carbon energy capacities. In this context, natural gas stands as a viable transition fuel given its ability to significantly reduce emissions and because it produces 40% fewer emissions than coal and 20% fewer than oil. Combine that with its energy security imperative and the region can be seen actively expediting its natural gas supply. In fact, 70% of the world’s additional capacity for regasification—the process by which liquified natural gas (LNG) is converted back to natural gas—currently comes from Asia, with around 22.7 trillion cubic feet to be added between 2023 and 2027.

Meanwhile, nations across Asia are looking to accelerate their domestic natural gas supply by leveraging an abundance of reserves and cost competitiveness. India, for example—a country the IEA projects will drive 25% of global energy demand growth in the next two decades—aims to add 7-15% more natural gas to its energy mix. The country is opening new frontiers by signing memorandums of understanding with international players to potentially explore and develop gas resources in deepwater regions. China's domestic natural gas production is projected to increase by a 4.6% compound annual growth rate (CAGR) from 2020 to 2030, driven by a rise in demand due to continue past 2030 along with its strategic use of natural gas as a bridge fuel. Indonesia has also set the target to increase its gas production from 7 to 12 billion cubic feet (Bcf) per day by 2030.

Investment in natural gas across Asia holds a promising outlook. LNG production is projected to grow at 7.6% CAGR until 2030. The sanctioning of impending upstream energy development is mainly driven by gas prospects, with major movement anticipated in offshore and deepwater regions via a mixture of both tiebacks (connecting new discoveries to existing production centers) and greenfields.

Tapping into these gas resources will potentially require new infrastructure and emission control measures, providing both opportunities and challenges. It won’t be easy, but it is doable if the region focuses on accelerating its tech adoption, setting regulation frameworks and incentive policies, and enabling more collaboration to unlock value.

Asia’s energy tech adoption must move faster

While potential for further adoption across the full value chain exists, accelerating tech adoption really begins with applying digital at the subsurface level. The Australasia region, being the leading gas producer in Asia Pacific and the world’s second-largest LNG exporter, is a good example. The region’s success stems from implementing digital across everything from subsurface evaluation and field deployment planning to accelerated time to production. This is no surprise given how much digitalization helps producers reduce factors like cycle time and tech implementation, while enabling production and emission control design for the long run.

Today, operators across Asia (including national oil companies), are seen integrating data to accelerate their field development planning and optimize their assets’ production performance. This is generally being done within an artificially intelligent environment known for vastly improving both efficiency and investment decision-making. Adopting the latest advancements in production and infrastructure is key to unlocking Asia's stranded gas. An AI-powered cloud platform, for example, has the power to produce the most effective designs for maximizing return on investment through subsea and tieback techniques.

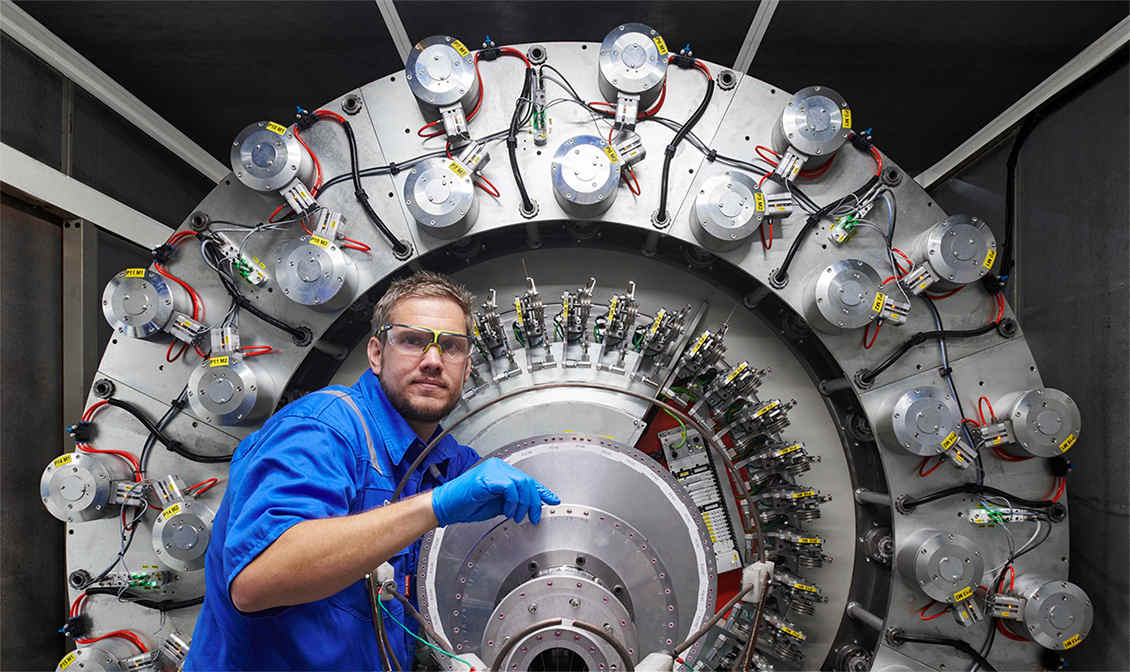

Once production begins, further enhancements can be achieved by leveraging the intelligence of today’s floating production, storage, and offloading (FPSO) systems and subsea multiphase compression systems. The latter is but one hardware solution that can also be retrofitted into existing assets to boost production—oftentimes a sensible course of action given its sustainability (compared to starting over with something new). In the Norwegian North Sea, for example, an operator successfully extended the life of its mature Gullfaks South Field by introducing this tech. Why? As field development matures, natural reservoir pressure tends to decline, thereby slowing production and reducing recovery. The operator anticipated this issue by implementing a solution to offset that lack of pressure, thus continuing to recover the reservoir’s remaining large volume of gas.

Subsea compression is compelling because the system is located close to the reservoir, meaning it’s more energy efficient, not to mention the cost benefits of its reduced weight and space requirements on the top side. Development of these subsea multiphase compression systems continues to mature and can now even support onshore gas processing plants. In fact, up to 30% of additional gas production can be unlocked with over 50% less power consumption compared to conventional top-side solutions.

All of this shows that we can look beyond the upcoming final investment decisions regarding greenfield assets—giving a relook at the potential economics of existing "stranded" assets. Meanwhile, in midstream, global collaboration across industry players is allowing for the development of digital capabilities that improve the reliability, availability, safety, and efficiency of these critical assets—all while lowering the carbon footprint of FPSO offshore operations.

Asia needs policies that incentivize and de-risk gas development to entice investors

Similar to other regions, collaboration between governments and key industry players is critical for Asia’s successful energy transition. Pooling resources, knowledge, and capacity building can launch more viable initiatives, while clear taxation law and definitions give major investors the confidence to move forward with their decisions.

Notable advancements are seen in specific areas across Asia Pacific. India is emerging as a prominent frontier when it comes to exploration. Malaysia saw great success in its recent bid rounds with international players thanks to improved fiscal terms, access to data, and greater industry engagements. Meanwhile, countries such as Vietnam and Bangladesh that possess untapped reserves, recognize that they need clear, well-structured cost recovery and taxation frameworks to instill investor confidence and unlock local recovery potential.

Investment reassurance is growing in tandem with the evolving objectives of exploration and production companies, which now prioritize not only expanding their reserves, but also tapping into opportunities with existing productive assets. For this, they tend to favor gas production in countries with simpler policies and regulations, and Asia is answering the call. Several nations have already revitalized their fiscal and regulatory frameworks, resulting in sustained interest from major energy players and new entrants. This trend is evident in the successful exploration award seasons of Malaysia, Indonesia, and Thailand.

Collaboration is key to addressing Asia's energy challenges quickly and at scale

As an industry, we are mandated to deliver more energy with fewer emissions. At the same time, demand growth is outpacing the speed of renewable or low-carbon energy capacity. Our industry needs to master the balancing act of delivering the energy the world needs while minimizing the impacts of climate change and, to address this challenge, the oil and gas value chain must evolve to be more deeply rooted in collaboration and partnership. We have tech today that can be deployed at scale, but further innovation is still required—an opportunity we can pursue together.

We are currently witnessing the formation and growth of a novel consortium model that brings together a diverse range of stakeholders to drive innovation. This consortium combines companies and tech—joined by private equity firms, midstream players, oil and gas companies, and industry—to address critical obstacles across the gas industry. For instance, they might collaborate on emission-reducing projects such as developing and implementing advanced carbon capture and storage tech or exploring sustainable energy solutions that unlock stranded gas reserves with limited infrastructure.

One thing is certain: This kind of multidimensional approach is essential if we wish to tackle the increasingly interconnected and complex hurdles in our world's transition to net zero.